Master data sheet FAQ

Here you will find our instructions for filling out the master data sheet. This page is optimized for mobile devices to assist you in completing the master data sheet on-site. If your questions are not sufficiently answered here, please inform us, we will add missing information at short notice. Thank you very much.

1. name and first name

Please enter only the surname and first name entered on your identity card or passport.

2. birth name

The birth name is the family name acquired at birth. You only need to fill in the field if your birth name is different from your name due to marriage or similar.

3. stage name

Please only enter your artist name if it is registered on your identity card.

4. date of birth

Please provide your full date of birth.

5. place and country of birth

Please indicate your place and country of birth.

6. marital status

Engaged or single are not family statuses. Use only the following marital statuses: single (= never married or partnered), married, registered partnership, separated, divorced, widowed.

7. address (street and house number, postal code, place of residence)

Your residency information must be correct and complete. Please always include the house number with the street. You confirm on the master data sheet that you have a permanent residence at the specified location and maintain your own household. If the data is not correct, there will be opposition from the social security agencies when reporting and accounting for your employment.

8. nationality

Please indicate your nationality. Non-EU citizens: Your residence and work permit must be available as a scan or copy. It is not sufficient to show them at the place of employment.

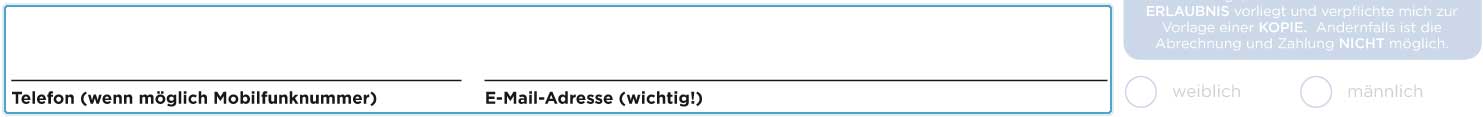

9. telephone and e-mail address

Please provide a mobile phone number and a valid, current and ideally always the same e-mail address. This allows for a complication-free and quick payroll and payment of your wages in the event of inquiries about your payroll.

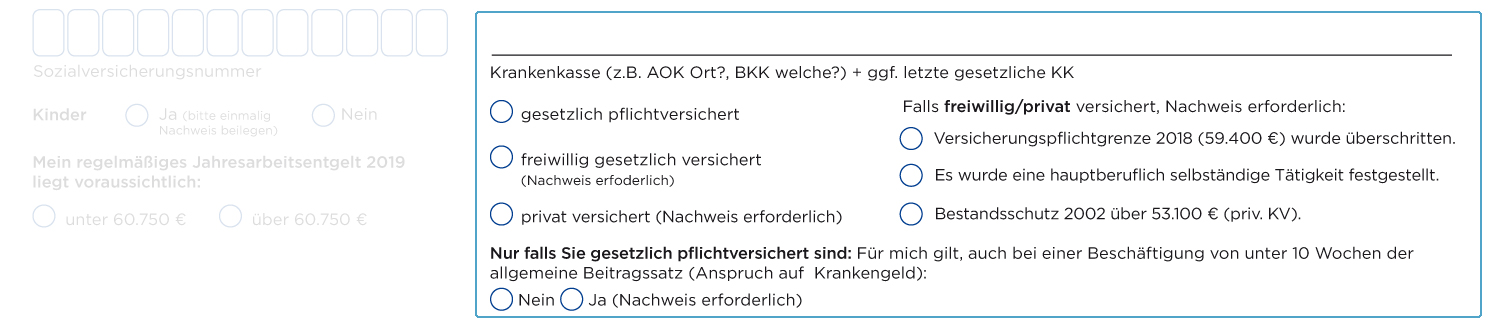

10. social security number

Your social security number can be found on your social security card, on official letters from your health insurance fund, letters from the German Pension Insurance Fund, or can be obtained by calling your health insurance fund. It is awarded for the first time when employment (also mini-job) is taken up.

The social security number is formed according to the following paragraphs: Area number, date of birth, first letter of birth name, serial number and check digit. Example of the structure of a social security number: 12 123456 A 123.

11. health insurance

AOK, IKK or BKK is not a sufficient indication of your health insurance. We cannot bill your wages with these designations! A prerequisite for billing is the exact and complete name of your health insurance company. This can usually be found on the insurance card. Examples: AOK Nordost, AOK Bayern, IKK classic, IKK Südwest, BKK Linde, BKK ProVita, etc.

If you are privately insured, please also enter the health insurance company with which you were last insured by law.

We require the additional information for privately/voluntarily insured persons in order to check whether you are subject to compulsory health/care insurance.

12. parental status

Employees who are childless pay a supplementary contribution to long-term care insurance. The surcharge does not apply to persons who provide proof of their parental status, e.g. by means of a birth certificate, child benefit statement/account statement or similar. The proof must be provided once.

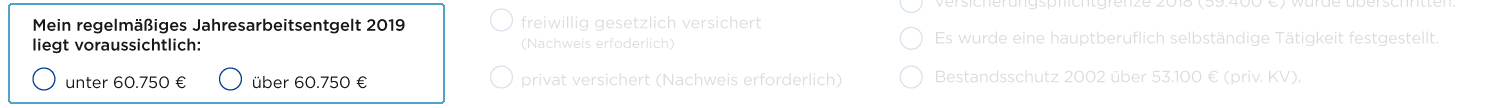

13. compulsory insurance limit

If your expected regular annual salary in the current calendar year exceeds the compulsory insurance limit, you are exempt from health insurance.

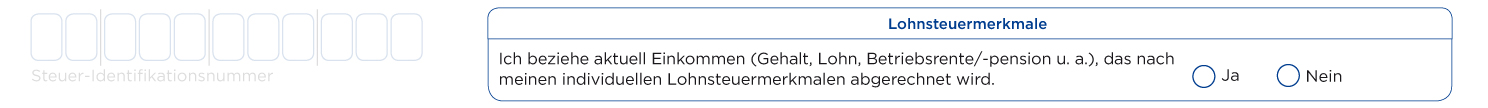

14. tax identification number

The tax ID is a nationwide and permanent 11-digit identification number of citizens registered in Germany for tax purposes. It is required for the determination of individual wage tax characteristics by means of the ELStAM procedure. All German citizens, including children, have had an individual tax ID since 2008. You can find this in your income tax assessment, your wage tax certificate or the information letter from your tax office. If you have misplaced, lost or forgotten your tax identification number, you can have it communicated to you again at the Federal Central Tax Office.

15. ELStAM (E)

When calculating your wages, we must distinguish between main employment (tax class 1 – 5) and secondary employment (tax class 6) distinguish.

O Yes: You currently receive income that is calculated according to your individual income tax characteristics (tax bracket 1-5). Consequence: We will account for your salary as a sideline (tax class 6).

O No: You do not currently receive income that is calculated according to your individual income tax characteristics. Consequence: We will account for your salary as your main employment (tax class 1 – 5).

What happens if no cross is placed on your part?

adag Payroll Services GmbH will contact you to clarify this issue. If we do not receive a response from you, we will account for your wages as a secondary job via tax class 6.

What happens if a wrong cross is placed on your part?

If you currently receive income that is accounted for according to your individual wage tax characteristics (e.g. salary), and you indicate to us that we can account for your salary as your main employment, the income from your main employment (e.g. salary) will subsequently be accounted for via wage tax class 6 during the next payroll run. This is because our reporting of your activity as a main occupation has the effect of classifying your actual main occupation as a secondary occupation. This has relevant disadvantages for you.

Please fill out this part of the master data sheet with special care and attention! If we reported your job as your main job, we cannot correct the classification of your current main income as a secondary job! This can only be your primary employer or the job from which you receive your primary income. Please note that mini-jobs are also often accounted for via tax class 1. If in doubt, please check with your payroll office.

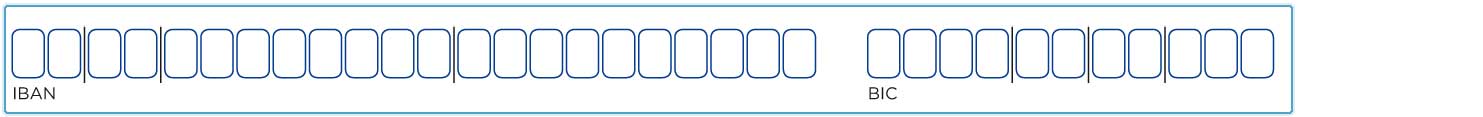

16. bank details (IBAN and BIC)

For the purpose of a reliable and quick transfer of your salary, the IBAN must always be stated in full. For transfers to other EU countries, the BIC must always be indicated as well! We cannot make transfers to bank accounts outside the EU. Please also note that we are not always able to take into account constantly changing bank details, especially in the case of closely successive days of operation, as the data is always taken from the most recent master data sheet.

Structure of the IBAN: At the beginning of the IBAN is the country code (e.g. Germany: DE). This is followed by a two-digit check digit that protects the payee and payer against transmission errors when entering the IBAN. The German IBAN is followed by the bank code and the account number. If an account number has less than ten digits, it is usually left padded with zeros.

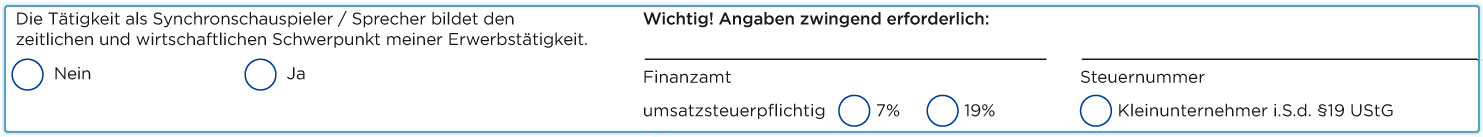

17. main occupation

If the activity as a speaker is the temporal and economic focus of your gainful employment, you will be counted as a non-permanent employee (person group 118). If this is not the case, you will be accounted for as an employee subject to social insurance (person group 117).

In both cases, you are a dependent employee under social insurance law, but you are self-employed under tax law and must pay tax on the income yourself.

The center of gravity of your gainful activity is to be reassessed for each employment. If there have been any changes to previous statements, please let us know.

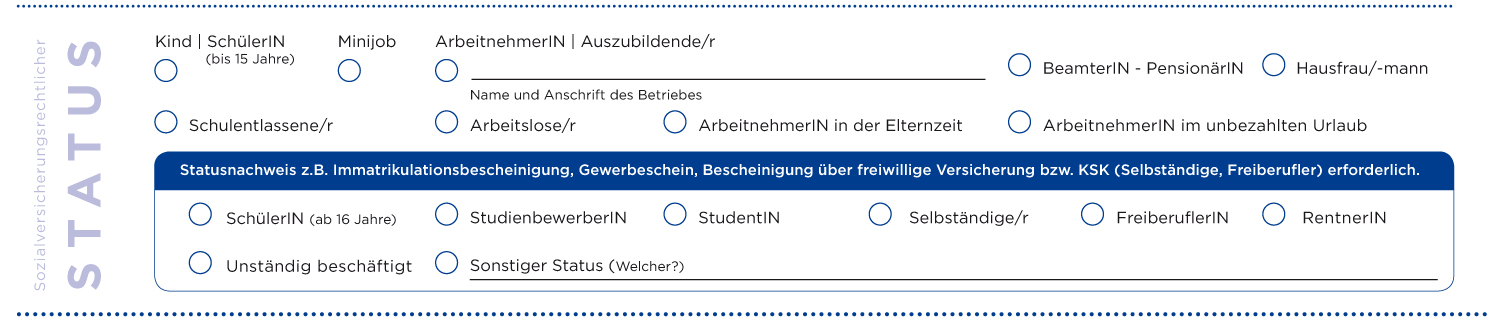

18. social security status

If you are not exclusively active as a speaker, but also have another listed status, please mark it accordingly.

This information helps us to assess which group of persons and which contribution group key to use when billing your fees.

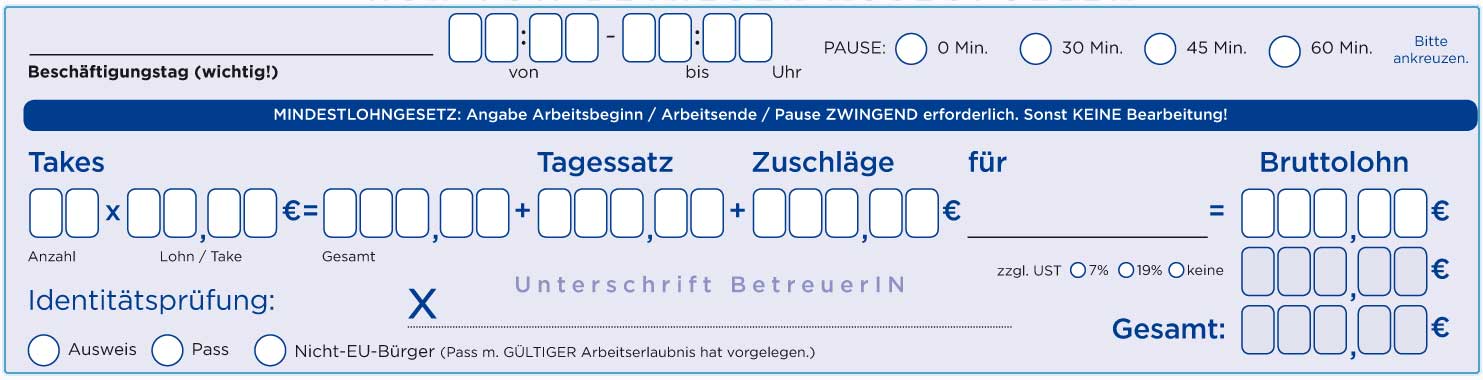

19. employment details (supervisor)

Please fill in all fields regarding the day of employment, working and break times and gross wages completely and confirm the entries with your signature. Please be sure to observe the legal regulations regarding the minimum wage, otherwise we will not be able to invoice you!

Minimum Wage Act: Since January 1, 2024, the statutory minimum wage has been 12,41 euros gross per hour worked. Among other things, the Minimum Wage Act makes it mandatory to document the start and duration of work. Processing of the master data sheets can only take place if the start of work, the end of work and the duration of the break have been correctly specified on the master data sheet.

Date of employment: The actual date of employment must always be stated!

Working hours and breaks: It is mandatory to record working times and breaks completely on the master data sheet.

Gross wage: Please break down the gross wage (takes, daily rate, supplements) and name supplements e.g. for night or holiday work accordingly. For non-permanent employees, see main employment (17.), we show the sales tax on the payroll.

20. signature of the employee

The master data sheet cannot be processed without the signature of the employee! This is self-explanatory.