Employment contract FAQ

Here you will find our instructions for filling out the employment contract. This page is optimized for mobile devices to assist you in completing the employment contract on-site. If your questions are not sufficiently answered here, please inform us, we will add missing information at short notice. Thank you very much.

1. civil name and civil first name

Please indicate only the civil name and first name registered in your identity card or passport. No payroll can be run on your wages based on a stage name or other alias.

2. birth name

The birth name is the family name acquired at birth. You only need to fill in the field if your birth name is different from your name due to marriage or similar.

3. date of birth

Please provide your full date of birth.

4. place and country of birth

Please indicate your place and country of birth.

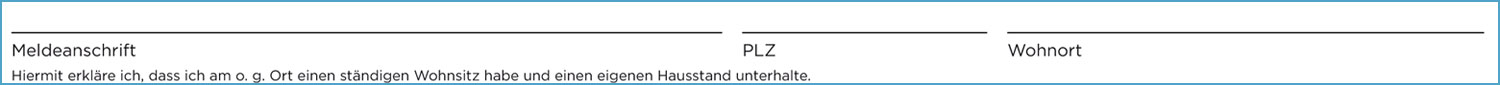

5. registration address (street and house number, postal code, place of residence)

Your residency information must be correct and complete. Please always include the house number with the street. You confirm on the employment contract that you have a permanent residence at the specified location and maintain your own household. If the data is not correct, there will be opposition from the social security agencies when reporting and accounting for your employment.

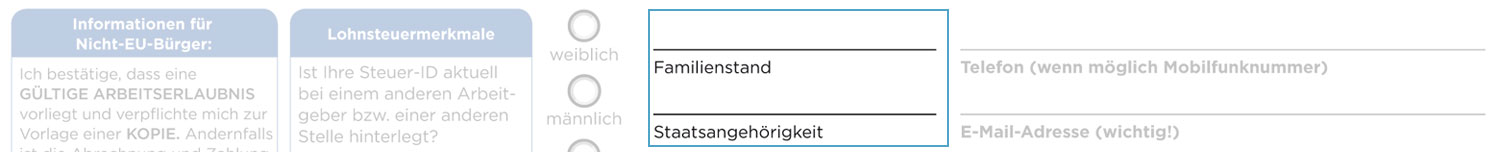

6. marital status

Engaged or single are not family statuses. Only use the following marital statuses: single (= never been married or partnered), married, registered civil partnership, registered civil partner deceased, registered civil partnership annulled, separated, divorced, widowed.

7. nationality

Please indicate your nationality. Non-EU citizens: Your residence and work permit must be available as a scan or copy. It is not sufficient to have them at the place of employment

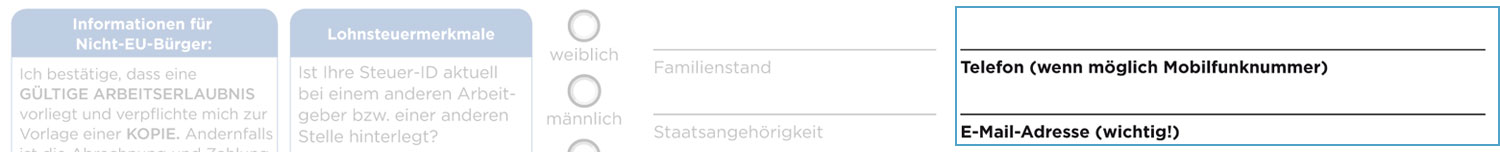

8. telephone and e-mail address

Please provide a mobile phone number and a valid, current and ideally always the same e-mail address. This allows for a complication-free and quick payroll and payment of your wages in the event of inquiries about your payroll.

9. wage tax characteristics (ELStAM)

When calculating your wages, we must distinguish between main employment (tax class 1 – 5) and secondary employment (tax class 6) distinguish. Is your tax ID currently on file with another employer or entity?

O Yes: You currently receive income that is calculated according to your individual income tax characteristics (tax bracket 1-5). Consequence: We will account for your salary as a sideline (tax class 6).

O No: You do not currently receive income that is calculated according to your individual income tax characteristics. Consequence: We will account for your salary as your main employment (tax class 1 – 5).

What happens if no cross is placed on your part?

adag Payroll Services GmbH will contact you to clarify this issue. If we do not receive a response from you, we will account for your wages as a secondary job via tax class 6.

What happens if a wrong cross is placed on your part?

If you currently receive income that is accounted for according to your individual wage tax characteristics (e.g. salary), and you indicate to us that we can account for your salary as your main employment, the income from your main employment (e.g. salary) will subsequently be accounted for via wage tax class 6 during the next payroll run. This is because our reporting of your activity as a main occupation has the effect of classifying your actual main occupation as a secondary occupation. This has relevant disadvantages for you.

Please fill out this part of the employment contract with special care and attention! If we reported your job as your main job, we cannot correct the classification of your current main income as a secondary job! This can only be your primary employer or the job from which you receive your primary income. Please note that mini-jobs are also often accounted for via tax class 1. If in doubt, please check with your payroll office.

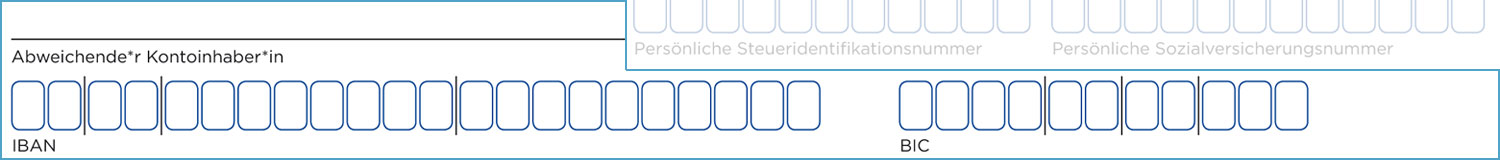

10. tax identification number

We need the identification number to be able to retrieve your income tax deduction details. This is different from the tax number you received, for example, in the context of a freelance activity or for the tax return.

The tax ID is a nationwide and permanent 11-digit identification number of citizens registered in Germany for tax purposes. It is required for the determination of individual wage tax characteristics by means of the ELStAM procedure. The tax ID consists of eleven digits (without hyphens, dashes or letters), which are assigned only once, are unchangeable and exist for life.

All German citizens, including children, have had an individual tax ID since 2008. You can find this in your income tax assessment, your wage tax certificate or the information letter from your tax office. If you have misplaced, lost or forgotten your tax identification number, you can have it communicated to you again at the Federal Central Tax Office or ask the tax office for it.

11. social security number

Your social security number can be found on your social security card, on official letters from your health insurance fund, letters from the German Pension Insurance Fund, or can be obtained by calling your health insurance fund. It is awarded for the first time when employment (also mini-job) is taken up.

The social security number is formed according to the following paragraphs: Area number, date of birth, first letter of birth name, serial number and check digit. Example of the structure of a social security number: 12 123456 A 123.

12. bank details (IBAN and BIC)

In order to ensure a reliable and quick transfer of your salary, the IBAN must always be stated in full. For transfers to other EU countries, the BIC must always be indicated as well! We cannot make transfers to bank accounts outside the EU. Please also note that we are not always able to take into account constantly changing bank details, especially in the case of closely successive employment days, as the data is always taken from the most recent employment contract.

Structure of the IBAN: At the beginning of the IBAN is the country code (e.g. Germany: DE). This is followed by a two-digit check digit that protects the payee and payer against transmission errors when entering the IBAN. The German IBAN is followed by the bank code and the account number. If an account number has less than ten digits, it is usually left padded with zeros.

13. different account holder

If you are not the account holder, please enter the first and last name of the person who holds the account.

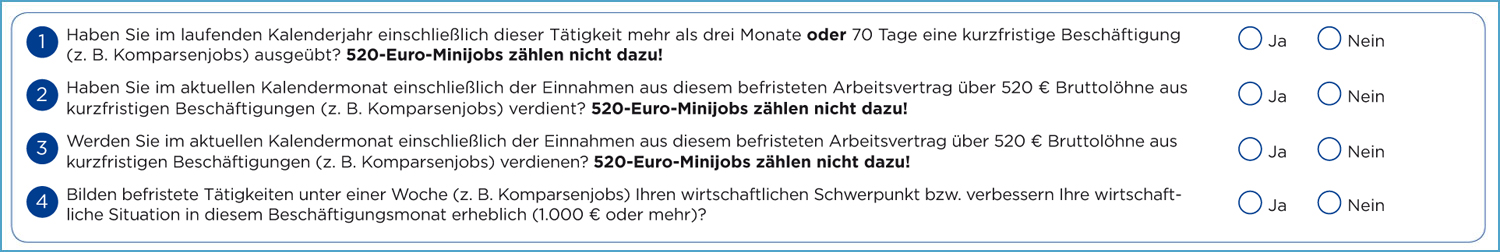

14. data 1 – 4

This information is mandatory for all. Please always fill out this section completely and conscientiously.

to 1)

If you have already worked in one or more short-term jobs for more than three months or 70 days in the current calendar year (e.g. series of extras; permanent jobs such as 538-euro mini-jobs are not included), you can no longer be accounted for as a short-term employee free of social security contributions.

In this case, we must charge you social security. In addition to income tax, social security contributions are then also due.

Please answer “yes” if you have already had one or more short-term jobs for more than three months or 70 days in the current calendar year (e.g. series of extras; permanent jobs such as 538-euro mini-jobs are not included).

Please answer “no” if you have not worked in one or more short-term jobs for more than three months or 70 days in the current calendar year (e.g. series of extras; permanent jobs such as 538-euro mini-jobs are not included).

to 2)

If your income from short-term employment exceeds 538 euros gross in the current calendar month, we have to check whether you can be accounted for as a short-term employee free of social insurance or whether you have to be accounted for as an employee subject to social insurance (check of professional status). Your status under social security law is then decisive for this decision.

Please answer “yes” if you have already earned more than 538 euros gross from short-term employment in the current calendar month, including your income from this employment contract (e.g. series of extras; permanent employment such as 538-euro mini-jobs are not included).

Please answer “no” if you have not yet earned more than 538 euros gross from short-term employment in the current calendar month, including your income from this employment contract (e.g. series of extras; permanent employment such as 538-euro mini-jobs do not count here).

to 3)

If you know at this point in time that your income from short-term employment will exceed 538 euros gross in the current calendar month, we must check whether you can be accounted for as a short-term employee free of social insurance or whether you must be accounted for as an employee subject to social insurance (verification of professionalism). Your status under social security law is decisive for this decision.

Please answer “yes” if you currently know that your income from short-term employment will exceed 538 euros gross in the current calendar month (e.g. series of extras; permanent employment such as 538-euro mini-jobs are not included).

Please answer “no” if you currently know that your income from short-term employment will not exceed 538 euros gross in the current calendar month (e.g. series of extras; permanent employment such as 538-euro mini-jobs are not included).

to 4)

If the income and time spent on all assignments as an extra exceed the income and time spent on your permanent or self-employed activities in the current calendar month, you can no longer be billed as a short-term employee free of social security contributions, but must be billed as a non-permanent employee.

Note: If you are a student, for example, and the extra series is your only source of income, but your main focus is on your work as a student, you can be accounted for as a short-term employee. Please answer the question accordingly with “no”.

Answer “yes” to this question only if temporary activities are less than one week,

z. e.g. as an extra, actually form the clear economic and temporal focus of your gainful employment in the current calendar month, or significantly improve your economic situation in this month of employment (1,000 euros or more).

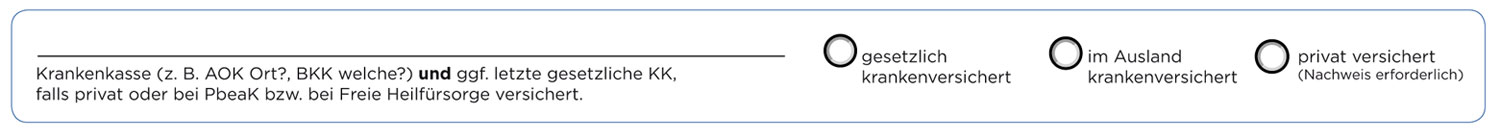

15. health insurance

AOK, IKK or BKK is not a sufficient indication of your health insurance. We cannot bill your wages with these designations! A prerequisite for billing is the exact and complete name of your health insurance company. This can usually be found on the insurance card. Examples: AOK Nordost, AOK Bayern, IKK classic, IKK Südwest, BKK Linde, BKK ProVita, etc.

Please also inform us of the type of health insurance you have (e.g. statutory or private insurance) and provide us with the required proof, if applicable.

If you are privately insured, please also inform us of your last statutory health insurance. If you have never had statutory insurance, please let us know that as well. We will then exercise the right to choose a health insurance company and enter an AOK in your state. If you reside abroad, we will enter an AOK in the state of the production company instead.

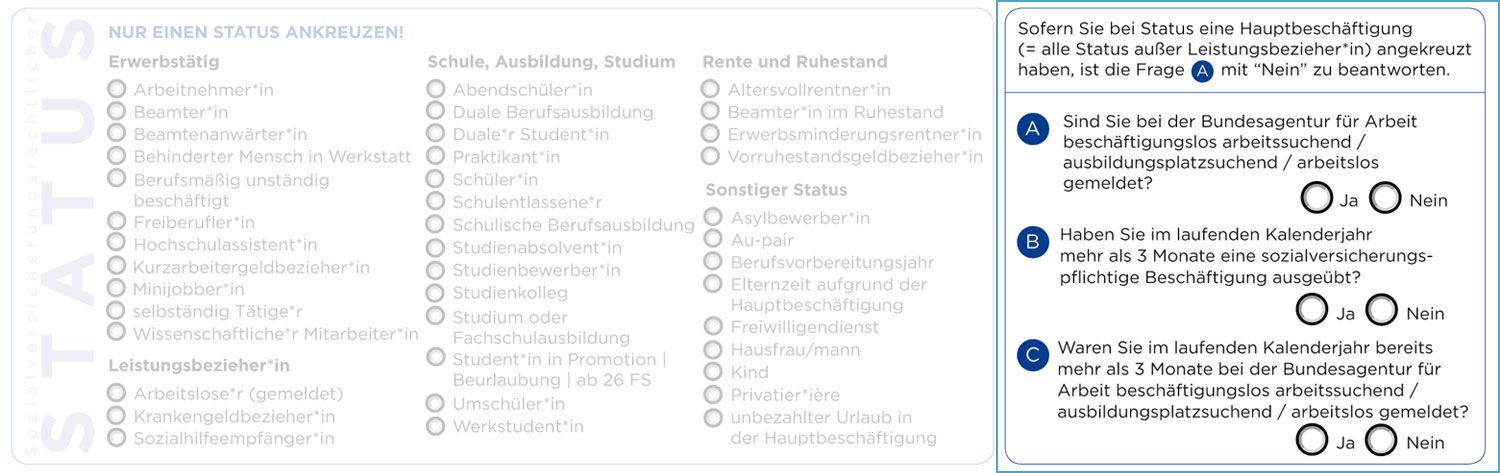

16. social security status

Important: please tick only one status! Only one status can be considered in your payroll. If you are a student, for example, you cannot have self-employed status at the same time. The classification with your health insurance company is often decisive. Please enter your correct social security status here. If you believe that more than one status applies to you, please check only the one that is of greater time and economic significance.

Proofs can be submitted directly to us as a copy by mail, by fax or as a scan or photo by e-mail. If your monthly remuneration from short-term employment exceeds € 538 and thus a check of professionalism must be carried out, we cannot confirm your status and account for your wage as short-term employment without the relevant evidence!

The following evidence is required when exceeding a monthly remuneration of € 538 from short-term employment:

Gainfully employed

- Employee: no proof of status, but name and location of employer required

- Civil servant candidate: no proof if you have statutory health insurance or certificate of private health insurance*.

- Civil servant: Proof of employment or certificate of private health insurance*.

- Minijobber*in: no proof of status

- Self-employed person: trade license and certificate of voluntary/private health insurance*.

- Freelancer: written confirmation from the tax office about your activity and certificate of voluntary/private health insurance* or notice from the Künstlersozialkasse (social security fund for artists).

- Scientific employee: no proof of status, but name and location of the college/university or institute is required.

- University assistant: no proof of status, but name and location of the college/university or institute are required.

- Disabled person in workshop: no proof of status, but information on name and location of rehabilitation facility required

- Professionally unemployed: no proof of status; certificate of private health insurance*.

- Recipient of short-time allowance: no proof of status, but name and location of employer required

Beneficiary

- Unemployed (registered): no proof of status

- Welfare recipient: no proof of status

- Sickness benefit recipient: no proof of status

School, training, study

- Pupil: current student ID or school certificate, from 25 years of age additionally certificate of voluntary / private health insurance*.

- School leaver: no proof of status

- Applicant: Confirmation of the university, from 25 years of age additionally certificate of voluntary / private health insurance*.

- University or technical college education: Certificate of enrollment stating the semesters of study, from 30 years of age additionally certificate of voluntary / private health insurance*.

- Student* in doctoral studies | leave of absence | from 26 FS: no proof of status

- Evening student: current student ID or school certificate

- School vocational training: current student ID or school certificate

- Dual vocational training: no proof of status, but information on the name and location of the training company is required.

- Retrainee: Confirmation from the Federal Employment Agency

- Trainee: proof of internship

- Studienkolleg: Confirmation of the university

- Dual student: no proof of status, but name and location of employer required

- Working student: Certificate of enrollment stating the semester of study, from 30 years of age additionally certificate of voluntary / private health insurance*.

- Graduate: no proof of status

Pension and retirement

- Full pensioner*: no proof of status, under 65 years pension certificate required

- Recipient of early retirement benefits: no proof of status

- Retired civil servant: pension certificate or certificate of private health insurance*.

- Pensioner with reduced earning capacity: pension certificate

Other status

- Child: no proof of status

- Housewife/husband: certificate of voluntary / private health insurance

- Privatier*ière: certificate of voluntary / private health insurance

- Parental leave due to main employment: no proof of status

- Unpaid leave in the main employment: no proof of status

- Vocational preparation year: certificate of enrollment from the sending school or confirmation of admission

- Au-pair: au-pair contract, certificate of au-pair stay from the host family or au-pair certificate as a reference from the host family

- Voluntary service: validservice card

- Asylum seeker: no proof of status

* In the case of persons with statutory insurance, the certificate must clearly state that you are voluntarily insured, i.e. that your health insurance premiums are not paid by third parties. Copies of health insurance cards are therefore not sufficient as proof. For privately insured persons, proof of health insurance is always required. Here, the health insurance card is also not sufficient. Please submit a membership certificate, certificate of insurance, confirmation of insurance, dues invoice, dues change, or similar.

Proof is also required for members of the Postbeamtenkrankenkasse and the Freie Heilfürsorge.

All documents should be from the current year or no older than one year.

17. additional information (A, B, C)

This information is mandatory for all. Please always fill out this section completely and conscientiously.

to A)

If you have already earned more than 538 euros gross from short-term employment in the current calendar month, including your income from this employment contract (e. g. If you are unemployed and registered with the Federal Employment Agency as a jobseeker, trainee or unemployed (with or without benefits), you can no longer be counted as a short-term employee free of social security contributions.

In this case, we must charge you social security. In addition to income tax, social security contributions are then also due.

Please note: Pupils who only register with the Federal Employment Agency during their school education in order to obtain a training place do not have to pay social security contributions for the duration of their school education.

Please answer “yes” if you are unemployed and registered with the Federal Employment Agency as a jobseeker, trainee or unemployed. It does not matter whether you are receiving benefits or not.

Please answer “no” if you are not registered with the Federal Employment Agency as a jobseeker, trainee or unemployed.

to B)

First of all, please note that this question only refers to previous employment for which you have been paid social security contributions (this does not refer to marginally paid employment (538-euro mini-jobs) or short-term employment with a gross pay of up to 538 euros per month).

If you have been employed for a total of more than 3 months or 70 working days in the current calendar year and your income from short-term employment in the current calendar month, including your income from this employment contract, already exceeds 538 euros gross, you can no longer be accounted for as a short-term employee free of social security contributions.

In this case, we must charge you social security. In addition to income tax, social security contributions are then also due.

Please answer “yes” if you have been employed for more than 3 months or 70 working days in the current calendar year. It is not necessary to additionally state the period during which you were employed subject to social insurance contributions.

Please note: If your current status is civil servant or employee and you have been continuously employed by only one employer in the current calendar year, you can answer the question with “no”.

Please answer “no” to this question even if you have not worked in one or more jobs subject to social insurance contributions for more than 3 months or 70 working days in the current calendar year.

to C)

Periods of registration as a trainee or jobseeker with unemployment are equivalent to periods of employment (see question B).

In the current calendar year, were you more than 3 months at the Federal Employment Agency unemployed looking for a job, training place or registered as unemployed and your income from short-term employment in the current calendar month, including your income from this employment contract, already exceeds 538 euros gross, you can no longer be accounted for as a short-term employee free of social security contributions.

In this case, we must charge you social security. In addition to income tax, social security contributions are then also due.

Please answer “yes” if you have already been registered with the Federal Employment Agency for more than 3 months in the current calendar year as an unemployed jobseeker, apprenticeship seeker or unemployed.

Please answer “no” if you have not been registered with the Federal Employment Agency for more than 3 months in the current calendar year as an unemployed jobseeker, apprenticeship seeker or unemployed.

18. employment details (supervisor)

Please fill in all fields regarding the day of employment, working and break times and gross wages completely and confirm the entries with your signature. Please be sure to observe the legal regulations regarding the minimum wage, otherwise we will not be able to invoice you!

Minimum Wage Act: Since January 1, 2024, the statutory minimum wage has been 12,41 euros gross per hour worked. Among other things, the Minimum Wage Act makes it mandatory to document the start and duration of work. Correct processing of employment contracts can only take place if the start of work, the end of work and the duration of the break have been correctly indicated on the employment contract.

Date of employment: The actual date of employment must always be stated!

Working hours and breaks: It is mandatory to record working hours and breaks completely on the employment contract (this also applies to castings and fittings) in order to ensure minimum wage-compliant payroll.

Gross wage: The gross wage must be at least equal to the legal minimum wage (€12,41/hour), this also applies to all overtime hours. Supplements, e.g. for night or holiday work, are not included in the calculation of the minimum wage. Please name the surcharges accordingly.

Employer’s stamp and signature: Please send us the employment contract signed and marked with your company stamp.

19. signature of the employee

The employment contract cannot be processed without the signature of the employee! This is self-explanatory.